I-Clique Solutions Limited (ICSL) is the local product implementation partner of Silverlake Symmetri Sdn Bhd (Malaysia) engaged in project works locally and globally to multiple banks. We have an experienced team of software engineers with foreign expertise for providing 24/7 support covering levels 1, 2 & 3 severability of software development work. At present we provide local support to several member banks using the Silverlake Axis OmniCard CMS services, which includes Comprehensive Debit & Credit Card services as well as ATM Controller and POS Management Services. We service e-commerce Issuing, Acquiring, Payment Gateways, Digital Platform etc.

Our expertise comprises working closely with International Payment brands such as VISA, MASTERCARD, AMEX, JCB, DINERS & CHINA Union Pay.

Simultaneously we are engaged heavily into project execution work throughout South Asia and other European countries.

Founded in 2009, Cynergon InteliSys Limited (CIL) is a self-funded company. CIL is the first and only developer of niche EFT solutions in Bangladesh. Its flagship product Latitude® has been developed from the ground up in Bangladesh utilizing indigenous resources adhering to the best practises adopted by some of the best and matured EFT solutions in the world. CIL has its core competencies in banking card issuance and management, ATM/EFTPOS driving and acquiring, multi-network multi-institution electronic transaction switching, routing and authorization. It is different from other EFT solution vendors in Bangladesh as it develops its own solutions and strives to innovate with its offerings.

CIL is looking at providing solutions to financial institutions to achieve and retain its competitive advantage by keeping pace with emerging trends like SaaS (Software as a Service), cloud computing and application virtualization. It stands ready to accept the challenge of any EFT requirement Bangladeshi financial institutions can pitch at the industry. It is capable of matching and even exceeding the standards and benchmarks set by any other world-class product in its category.

Presently, CIL has 3 active clients including 2 private sector banks by offering MasterCard Debit, Visa Debit and Proprietary ATM/Debit Card Solution. Projects underway include implementation of Visa, MasterCard Debit and Credit Chip Card solutions to its member banks.

Micro-Financing Project: Successfully implemented Prime Cash Micro-Finance project using biometric interface with over 3000 Agents throughout Bangladesh. Prime-Cash, is the first biometric based EFT solution to be implemented in Bangladesh using Latitude CMS & EFT Switch.

The Instrumental Clique (IC) is the “Supply Wing” of the I-Clique Group. IC specializes in all kinds of supply to cater to the fundamental needs in the Banking/Financial industry as well as Government Organizations and other Private and Public entities. Some of its core supply of products include EMV based Contact and Contactless Plastic Cards, Centralized EMV Issuance System, HSMs, Point-of-Sales (POS) Terminals, Hardware equipment, Servers, Routers, H/W peripherals etc.

IC ensures 100% security and robustness in quality as the standard of offered products are the highest and our staff are highly skilled and experienced to meet up to these criterions.

DGePay Services Limited, branded as DGePay, is the first Payment Service Operator (PSO) in Bangladesh to receive a White Label Merchant Acquiring (WLMA) NOC from Bangladesh Bank.

The Company is planning to establish the largest nationwide merchant payment network, enabling instant and secure money transmissions through the DGePay Mobile application.

In the current context of our nation, technology is being used in almost every aspect of life. A new horizon has opened up for the use of technology to complete commercial transactions, also known as e-commerce. The only app. that will make your life easier and safer is DGePay. You can transfer money from one bank account to another using your smartphone, while also using other financial service provider applications. Considering the needs of the common people of Bangladesh, DGePay will not only assist individuals, but shall also be a part of their daily lives.

People throughout the world avoid carrying cash with preference of using mobile financial services or debit/credit cards, paving the way towards a cashless society, which in turn offers numerous advantages e.g., less risk of fraud and robbery, no cash handling fee, no trip to the bank or ATM, shorter lines, and faster transit routes. To this added global adoption comes the recently introduced QR code (Quick Read Code) payment, which has created a new wave by allowing customer transaction coverage in mammoth lengths, starting from street sellers, small restaurants all the way to large retail stores and many more. Unlike cash or a credit card, QR codes are completely contactless and much easier to execute by simply scanning a merchant code in either static or dynamic mode. At present, the Central Bank of Bangladesh has issued a standard “Bangla QR” based code, which is expected to be adopted by all local users throughout the country.

Services Offered by DGePay:

Payment Aggregator

DGePay will establish secure connectivity between online market places and the core system of the Banks/PSPs/MFS’, thus enabling its customer base to make all payments online.

POS Purchase

Customers visiting a retail store for purchase shall obtain a secure payment network, other than cash for all related POS retail purchases.

Purchases from QR code at Retail Store

A QR code is a matrix barcode that contains data for an allocator, identifier, or tracker and links to a website or app. Customers in rural, suburban, and less commercially important parts of big cities shall be able to make payments here.

Merchant Payments

A transaction involving a manufacturer and a wholesaler, or a wholesaler and a retailer, is referred to as a merchant payment. Business-to-business (B2B) transactions are those that take place between businesses rather than between businesses and individuals. In Bangladesh, the distribution network of goods and service providers, particularly wholesalers of FMCG (fast moving consumer goods), are extensive. There might not be a village in the world that does not get its fair share of goods and services. Despite the manufacturing and service industries' huge distribution networks, banking services have not grown in lockstep. Because cash has so many drawbacks, FMCG companies prefer to avoid handling it. It is always desirable for suppliers of goods and services, as well as FMCG enterprises, to receive payments electronically rather than in cash. DGePay will encourage both merchants and their suppliers to use its system to make and receive payments. This will ensure that payment is made quickly, safely and accurately.

Cash Advance Services

Utilities and Value added services

Implementer of DG E-Pay/Prime Cash solution, where DGIL with the infrastructure of CIL and IC have successfully launched the entire DG E-Pay Prime Cash project using 32K SDA Java Cards with Biometric facility, where EFT disbursements are conducted via fingerprint impression authentication. Few target customers include; pension funds disbursement, life insurance, Micro-financing to the general population, banking facility to fishermen etc. using biometric authentication. The DG E-Pay solution is considered to be one of most unique methods of micro-financing to the unbanked population of Bangladesh and has received a global award from MasterCard International for product innovation. www.dgepay.com

Payment Card Industry Data Security Standards, widely expressed as PCI DSS is the Security Standard positioned by the PCI Securities Council. The standards are outlined to ensure that the technical and operational requirements of a Card Issuing/Acquiring entity to protect valuable Cardholder Data.

I-Clique Group has partnered with world renowned company ControlCase LLC. to offer comprehensive PCI DSS and Payment Application Data Security Standards (PA DSS) to multiple Banks and other Card issuing entities in Bangladesh. At present, ControlCase is considered to be the pioneer and largest provider of Compliance as a Service (Caas) packages. Additionally, ControlCase provides solutions that address all aspects of IT-GRCM (Governance, Risk Management and Compliance Management). ControlCase focuses on providing and developing services, software products, hardware appliances and managed solutions. The solutions help organizations manage Governance, Risk Management and Compliance related to IT operations. We provide solutions that help organizations address regulations and standards such as PCI DSS, ISO27001/2, Sarbanes Oxley (SOX), GLBA, HIPAA, CoBIT, BITS SIG/AUP, J-Sox, TG3, etc.

PCI related Compliance Services are the focus of the company. ControlCase has PCI experience on all sides of the card business, including the acquiring as well as issuing sides. Additionally, ControlCase has exposure to all links in credit card process chain Member Card organizations like VISA/MasterCard, Member Banks, Third-Party Processors (TPP), ISOs, DSEs, & IPSPs (Internet Payment Service Providers) and BPOs/KPOs etc. The Company is certified ASV vendor and a PCI DSS QSA and provide PA DSS and P2PE certifications.

At present, ICSL, Cynergon InteliSys Limited (CIL) and ControlCase caters to 9 of the prominent Banks in Bangladesh for building and maintaining Secure Network and Systems, Cardholder Data Protection, Access Control Measures, Monitoring and Testing Networks by complying with latest information security policies.

I-Health Solutions Limited (IHSL):

We are the exclusive distributor of Remedi REMEX-KA6, a portable handheld X-ray system engineered to transform the way you deliver care. Imagine high-resolution imaging at your fingertips, anytime, anywhere, whether in the urgency of an emergency room or the quiet of a patient's bedside. Originating from South Korea and FDA & CA approved, this advanced imaging technology becomes your most reliable partner, blending unmatched precision, seamless mobility, and uncompromising safety in one sleek device.

In critical moments where every second matters, the REMEX-KA6 empowers healthcare professionals to make rapid, accurate decisions, ensuring the best possible patient outcomes. This isn’t just portable imaging—it’s a revolution in how you diagnose, treat, and elevate patient care.

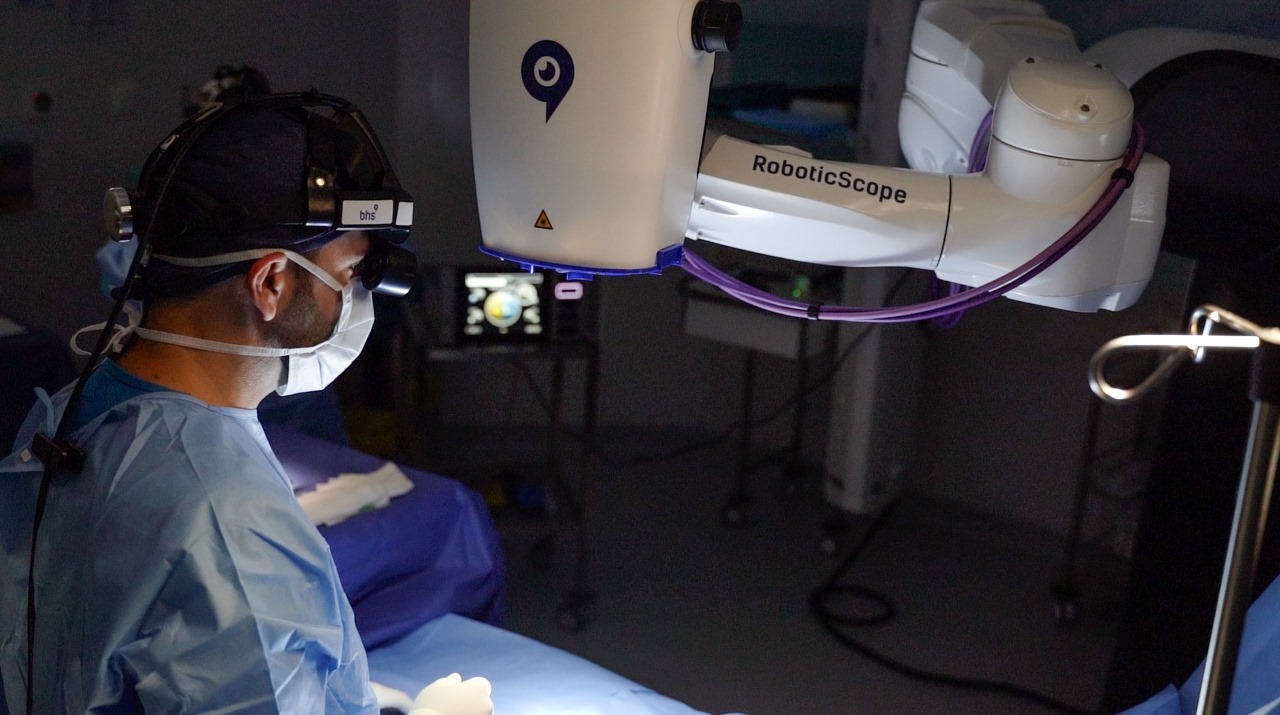

Welcome to the future of surgical microscopy. The RoboticScope by BHS Technologies is a groundbreaking digital surgical microscope designed to empower surgeons with unprecedented precision, comfort, and control. Say goodbye to the limitations of traditional microscopes and embrace a new era of hands-free, head-gesture-controlled 3D visualization.

The RoboticScope is a revolutionary system that detaches surgeons from the physical constraints of traditional microscopes. Leveraging cutting-edge robotics and a patented Head-Mounted Display (HMD), the RoboticScope frees surgeons to perform at their best—whether seated, standing, or in any posture that suits their comfort.

From ENT and neurosurgery to plastic surgery, the RoboticScope is designed to support a wide range of surgical disciplines, enhancing visualization, precision, and surgeon comfort. Its Orbit Mode and Free View features allow for continuous, uninterrupted focus on the surgical field, so you can adapt to any scenario in real-time.

Join the digital revolution in surgery with the RoboticScope. Experience the difference in precision, comfort, and control that only state-of-the-art technology can offer.

Pandorium Limited:

Among the many assortments of I-Clique Group, Pandorium is enlisted and registered as an Academic Center, which plans to roll out a world class Kindergarten in the Purbachal New Town area of Bangladesh. The proposed school is scheduled to be setup at the finest location in Sector 17 of Purbachal with a landscape of 29+/- Kathas of land with a designated play area for children. Proposed implementation plan is scheduled to be within year 2025.

Good Ventures Logistic Services (GVLS) est. Nov 2022, newest SBU of i-Clique Group is formed to pioneer in world of freight forwarding with multiple solutions to carry all types of shipments from one point to another, anywhere in the world, as our customer desires! May it be air or sea, land/sea, air/sea, or any multimodal, we are ready with full solution. For cross border /inland transport, we have premium trucking services of various types & sizes.

GVLS is managed by entrepreneurs of conglomerates and expert professionals of forwarding industry having experience from aircraft / vessel handling to cross border trucking to warehouse operations or project cargo.

With reliable and responsible partners all around the globe, we always look for new challenges to overcome to satisfy our patrons, our customers.

Welcoming queries - http://www.gvls.net/